capital gains tax services

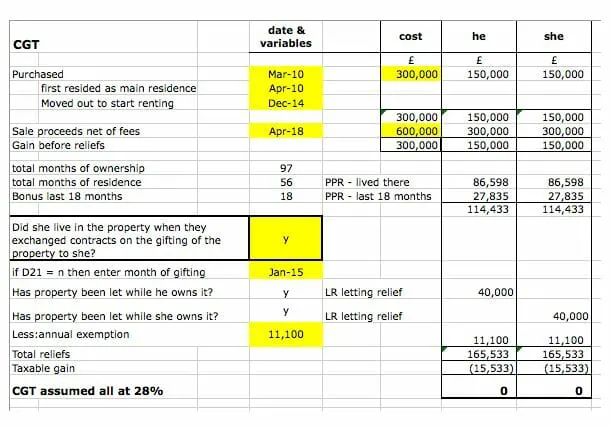

You must report all 1099-B transactions on Schedule D Form 1040 Capital Gains and Losses and you may need to use Form 8949 Sales and Other Dispositions of Capital Assets. 20 28 for residential property.

Green Valley Tax Services Inc Home Facebook

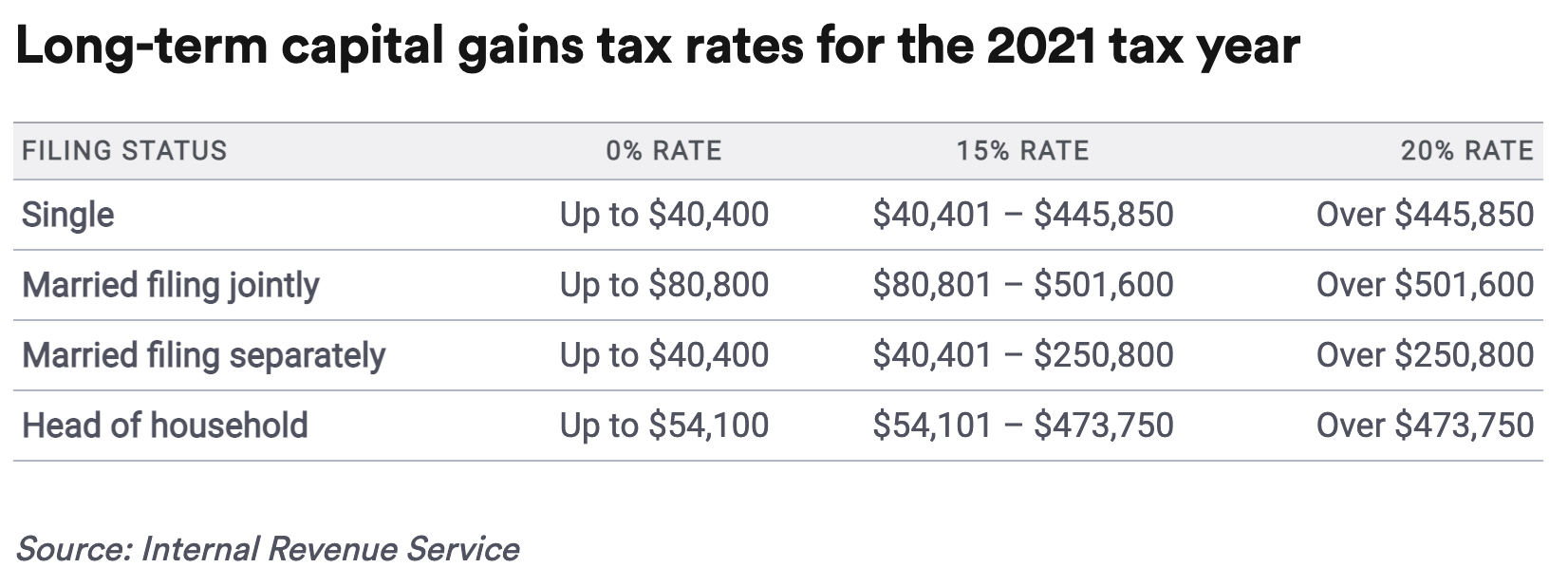

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

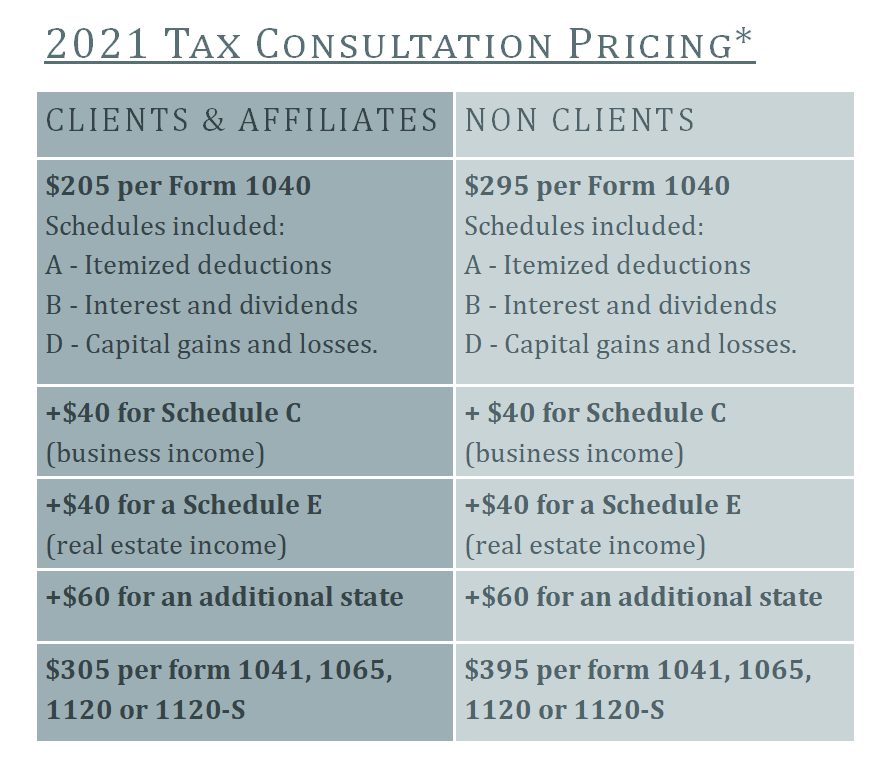

. Capital Gains Tax Services. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. How you report and pay your Capital Gains Tax depends whether you sold.

If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately. Capital gains taxes on. This is the same as the previous tax year and an increase from the 12000 allowance in the.

See reviews photos directions phone numbers and more for Capital Gains Taxes locations in Piscataway NJ. ICE Data Servicess Capital Gains Tax CGT services can help to improve the efficiency of the day-to-day work carried out by accountants tax professionals. 2022 capital gains tax rates.

The personal Capital Gains Tax allowance CGT allowance for the 202122 tax year is 12300. If your taxable gains come from selling qualified small business stock section 1202. Weve got all the 2021 and 2022 capital gains.

The capital gains tax on most net gains is no more than 15 for most people. Something else thats increased in value. For the 20222023 tax year these tax rates are 10 18 for residential property for your entire capital gain if your overall annual income is below 50270.

A rate of 40 can apply to the disposal of certain foreign life assurance policies and units in. Its the gain you make thats taxed not the. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value.

The standard rate of Capital Gains Tax is 33 of the chargeable gain you make. See reviews photos directions phone numbers and more for Capital Gains Tax Rate locations in. If your taxable income is less than 80000 some or all of your net gain may even be taxed at 0.

409 Capital Gains and Losses - IRS tax forms 4 days ago Oct 04 2022 Capital Gain Tax Rates. 2021 capital gains tax calculator. The tax rate on most net capital gain is no higher than 15 for most individuals.

What you need to do. Get assistance from trustworthy immigration agents near you to apply for Capital Gains Tax in Piscataway - Choose from list of reputed consultants based on their reviews and ratings on. If you sell collectibles art coins etc your capital gains tax rate is a maximum of 28.

A residential property in the UK on or after 6 April 2020.

Capital Gains Tax Solutions Tax Services 915 Highland Point Dr Roseville Ca Phone Number Yelp

Using Capital Gains To Pay For College Resilient Asset Management

Tax Services Strategies Archives Ironwood Wealth Management

Raising The Capital Gains Tax Who Does It Really Hurt U S Chamber Of Commerce

Kuow Wa Democrats Push For Capital Gains Tax In A Year When Tax Doesn T Seem Like A Bad Word

Capital Gains Tax On Sale Of Property Express Service

A Guide To Capital Gains Tax On Real Estate Sales The Ascent By Motley Fool

Ask Your Business Accounting Questions On Twitter If You Sold Stock Or Sold A House Recently That Profit Is Taxable By The Government Here Are A Few Strategies Recommended For Avoiding Or Reducing

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

What You Should Know About Capital Gains Tax Legalzoom

Schedule D Tax Form 1040 Instructions Capital Gains Losses

Selling A Business Capital Gains Tax In California Offset Taxes

Capital Gains Tax What It Is How It Works And Current Rates

What Are The Capital Gains Tax Rates For 2022 Vs 2021 Avitas Capital

Tax Loss Harvesting Capital Gains And Losses Strategic Tax Planning Accounting Services Business Advisors Mst

Edward B Harmon Biden S Tax Plan Would Damage Economy

What You Need To Know About Capital Gains Tax

Retirement Tax Services 5 Reasons Great Advisors Recommend Capital Gains Harvesting Meta Http Equiv Content Security Policy Content Script Src None